Foreclosure Defense

Cook County Mortgage Foreclosure Attorneys

Have you fallen behind on your mortgage on your Chicagoland property and you are unsure if the information your lender is providing you is accurate? Erica Crohn Minchella is a foreclosure attorney with more than 15 years of experience defending homeowners in the foreclosure process. There are steps that a foreclosure defense attorney can take to protect your rights and your credit, find solutions, while also helping you keep your dignity during the foreclosure process.

What is a foreclosure?

When you buy a home, that transaction involves two primary elements: 1. the promise to pay back the money, and 2. the creation of a lien against the property to ensure payment. A foreclosure occurs when the lender has not been paid and as a result, seeks to reclaim the property.

Foreclosures can occur against properties with reverse mortgages and commercial properties where there has been a default under the terms of the mortgage.

Steps you can take Pre-Foreclosure

Is there anything you can do pre-foreclosure to stop the foreclosure process from happening? First, pre-foreclosure has two meanings. To the lay person, it means what can she or he do after a default is entered but before the sheriff’s sale occurs. As experienced foreclosure attornies, we can take steps on your behalf before the foreclosure lawsuit is filed.

We will:

- Communicate with the lender to discuss options

- Determine what options and time frames will work best for the homeowner

- Explore how to cure defaults

- Look into refinancing options

Minchella & Associates can help you understand your rights, options and the best solutions for your individual circumstances, including, but not limited to doing a short sale, filing for bankruptcy protection, obtaining a loan modification or forbearance.

The foreclosure process can take at least 9 months during which time Minchella & Associates can help you find a solution.

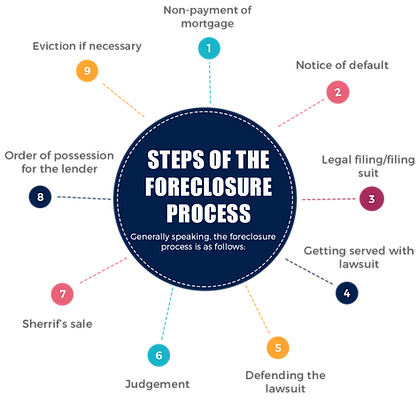

Steps of the Foreclosure Process

Generally speaking, the foreclosure process is as follows:

- Non-payment of mortgage

- Notice of default

- Legal filing/filing suit

- Getting served with lawsuit

- Defending the lawsuit

- Judgment

- Sherriff’s sale

- Order of Possession for the lender

- Eviction if necessary

Client had a Home Equity Line of Credit (HELOC) with a lender that had purchased her loan from a prior lender. Instead of giving her enough time to get a new loan, the lender let her know that her loan was coming due and that they would not renew. Not being able to find another loan in the 60 days that they gave her, she wound up in default and in foreclosure. It is virtually impossible to get a mortgage when you are in foreclosure. Erica helped her find a bridge loan that took her out of foreclosure. After 6 months, she was able to refinance into a conventional mortgage with terms that will assure no further defaults.